KYC and AML checks where a trust is involved

You are no doubt aware of the importance of carrying out KYC checks when dealing with property transactions. However, when a trust is involved, the process can become more complicated due to the complexity, and higher risk of money laundering.

In this article, we run through how KYC checks differ in this scenario and what you need to do to ensure compliance.

Why are trusts higher risk?

Understanding why trusts have a higher risk of money laundering can help you understand why certain due diligence measures are so important.

Here are some of the reasons why trusts are higher risk:

- Complex trusts and company structures can be used to layer funds or to disguise their true origin which could be illegal

- Virtual office addresses can be used to hide the true identity of businesses.

- The identity of the business owners can be hidden through nominee shareholders.

All of these factors above make buying and selling property through trusts a favourable way to launder money.

The UK government has been taking steps to reduce these risks, such as the 5th Money Laundering Directive which requires several types of trusts to be registered with the TRS, however many still don’t have to be.

KYC and AML checks for a conveyancing matter involving a trust: Step by step

It’s critical to apply a risk-based approach to detecting, and at times reporting, suspicious transactions when dealing trusts. Below is a guide to the steps your firm might take, but ultimately your firm needs its own set of policies and procedures that satisfy your firm’s risk appetite.

Identify all parties involved in the trust

The first step is to identify all the parties involved in the trust. This will typically include the trustee, any named beneficiaries, and any potential beneficiaries. You will also need to identify any settlors or other parties who have contributed to the trust.

It is also important to note that trusts can be complex legal arrangements, and there may be several types of trusts with different legal requirements. For example, a discretionary trust may have a wide range of beneficiaries who are not identified at the outset, which can make identifying the correct entities more challenging.

Identifying all individuals involved in the trust is a critical step, as criminals will often use trusts as they favour anonymity. Offshore trusts, those featuring bearer shares or legal entities like foundations could make it even harder to identify all of the parties involved.

Carry out KYC on all parties

Once you have identified all the parties involved, you will need to carry out KYC and AML checks on each person. This means verifying their identity, obtaining proof of address, and carrying out ongoing monitoring to keep an eye on their risk profile. The trustee will also need to provide information on the source of funds for the property purchase.

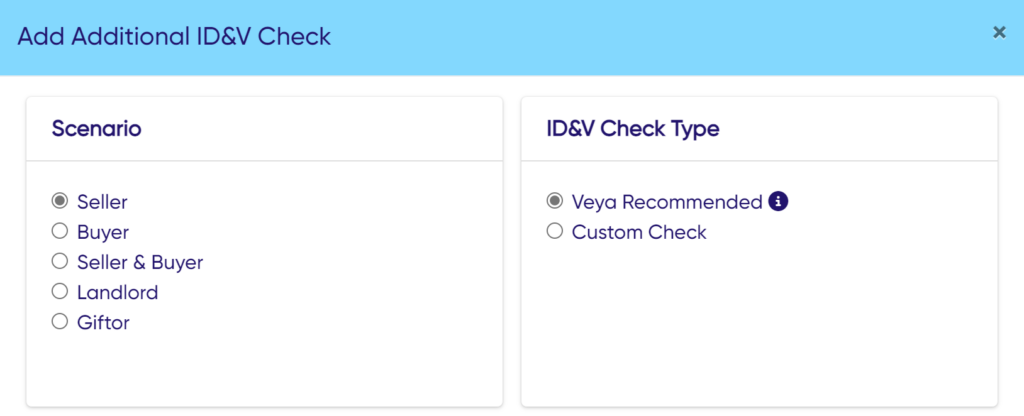

The level of checks you conduct may differ based on whether the client is a seller, buyer or both.

Below is a list of the checks that some, or all, will need to be completed based on the client’s scenario.

ID Check:

An ID check can be done manually, however we highly recommend using a digital ID verification tool to reduce errors and save time. Veya’s recommended Standard ID Check that can be conducted through our platform uses NFC technology and liveness detection for document and face matching authenticity.

PEP and sanction screening:

It’s imperative when conducting KYC checks on the individuals identified in the trust to run PEP and sanction screening. This is particularly important due to the risk of individuals using a trust to disguise themselves.

If you discover that your client is politically exposed, enhanced due diligence will need to be done so you can decide if you can act on the client’s behalf or not.

If the client comes up as a potential match on a sanctions list, you’ll also need to conduct enhanced due diligence. You will need to check the details on the sanctions list to determine if it was a false-positive, for example, perhaps their name matches, but all of the other details do not. If this is the case, you won’t need to take further action and can continue to work with them if you’re happy to do so. However, if all of the details are a match, you will need to suspend the transaction and report the person to OFSI.

Our Standard ID Check provides PEP and sanction screening across the global database.

Proof of Address:

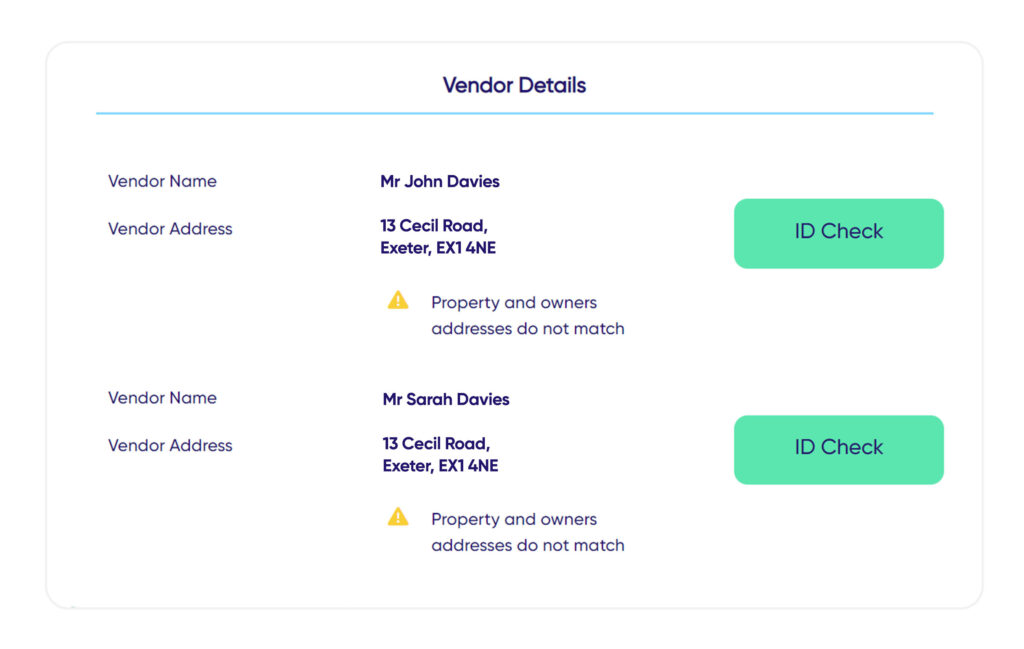

Proof of address is an important step in the ‘Know Your Client’ (KYC) process. If the address verification fails, this could be an indication of fraudulent activities. Proof of Address can be obtained by collecting an official document such as a council tax bill or bank statement.

To save time, Veya’s recommended Standard ID Check conducts a UK address match to verify the client’s passport address against the electoral roll.

Proof of Ownership:

Cross-referencing the proprietorship details in the title deeds against the client’s ID proves ownership of the property. It’s important to record that you’ve checked these details as evidence. Title checking and conducting due diligence should go hand in hand, but it’s often disjointed, with no clear process. The Veya Report highlights the proprietors, and provides a link to conduct an ID check, making the process as simple and seamless as possible.

Source of Funds:

If you’re dealing with monies as part of the transaction, it’s important to ensure that the source of funds has come from legitimate means. To do this, you will need to ask the client where the source of funds is from, and then review evidence such as bank statements or recently filed business accounts to confirm it.

Veya makes the process of getting proof of source of funds simple. Alongside the ID check, you can send a questionnaire which the buyer needs to fill in to indicate where the funds are from. Alongside that, you can request that they provide bank statement evidence as proof of their source of funds, which you can then cross check against the information given.

Keep an eye out for red flags

Throughout the onboarding stage and KYC checks, you should be looking out for red flags. Red flags are warning signs which can alert you to the possibility of money laundering.

Red flags to look out for specific to a trust include:

- The trust is involved in a high-risk jurisdiction

- Complex company structures with no clear purpose

- The trust has a shell company in an offshore jurisdiction

However, it’s important to also look out for generic red flags too:

- Evasive or suspicious client behaviour

- The transaction involves prime real estate

- Unusual source of funds such as a gift, loan or cash transactions

- The client’s location in relation to your firm

- Foreign nationals that are not British residents

- A transaction that’s unusual for your firm

- An early repayment of a mortgage/loan

These red flags are not exhaustive, if you deem anything to be suspicious, and it doesn’t have reasonable explanation, you should do further investigation as part of your KYC and AML checks.

Based on the red flags you discover and the nature of the individuals and the trust, you will need to carry out enhanced due diligence. This means collating further evidence to be able to prove beyond reasonable doubt that the transaction is good to proceed.. For example, you might need to carry out additional checks if the trust has connections to high-risk jurisdictions or if there are concerns around the source of funds.

Evidence

It is also important to keep accurate records that serve to evidence all your KYC checks when dealing with a trust. This will include details of the trust deed, the identity verification documents, and any other relevant information. These records should be kept for a minimum of five years, in line with AML regulations.

Ongoing monitoring

Ongoing monitoring is the process of reviewing client and matter due diligence periodically throughout the course of your relationship. This is particularly important where a trust is involved due to the number of risk factors and complexities of the trust.

In conclusion, conducting thorough KYC and AML checks are incredibly important, not just when a trust is involved in a property transaction.

The separation of legal and beneficial ownership and complex company structures within trusts gives an opportunity for criminals to distance and disguise their connection with the property used for criminal purposes.It is essential to identify all parties involved in the trust, verify their identity, and look out for red flags to ensure compliance with AML regulations.

By following these steps, you can ensure that your conveyancing practice is fully compliant with KYC and AML regulations when dealing with trusts.

Veya is a Land Registry Title Register analysis and ID&V tool for conveyancers. Book a demo with us to learn more.