Ultimate Beneficial Owner (UBO), explained

What does Ultimate Beneficial Owner (UBO) mean?

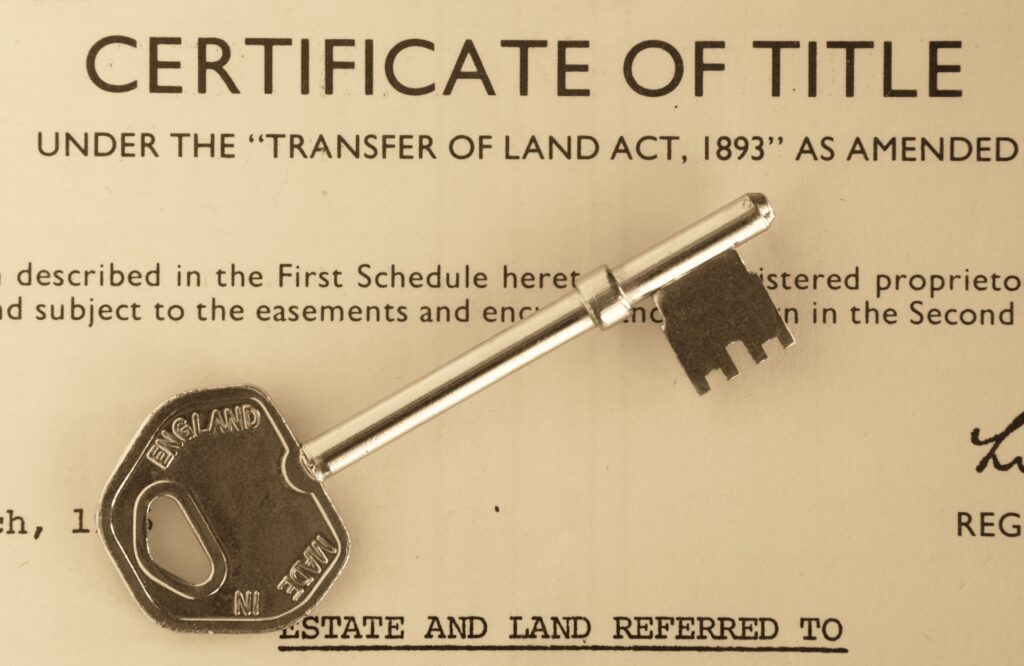

The term “ultimate beneficial owner” (UBO) is used to describe the person or persons who ultimately own or control a company or other legal entity such as a property. The UBO is the person who ultimately has a controlling interest in the property, whether that interest is direct or indirect. In other words, the UBO is the person who ultimately reaps the benefits of ownership of the property.

The term is often used in legal and regulatory contexts, particularly when it comes to Anti-Money Laundering (AML) compliance. This is because anonymous shell companies are one of the most common ways of laundering ill-gotten cash.

In order to comply with AML regulations, financial institutions are required to identify and verify the UBO of their clients. This helps to prevent financial crimes such as money laundering and terrorist financing.

Beneficial ownership of a property versus legal ownership

Beneficial ownership of a property is when an individual or organisation has the right to use and occupy the property, but not the legal title. In contrast, legal ownership of a property is when an individual or organisation has the right to use, occupy and sell the property.

The conveyancing process will identify the ultimate beneficial owner(s) of a property, as well as the legal owner(s). It is important to note that beneficial ownership is not always the same as legal ownership, especially in cases where there are multiple owners.

In the UK, both conveyancers and estate agents are required to carry out due diligence on their clients to ensure that they are not knowingly involved in money laundering or other criminal activities. This includes verifying the identity of the beneficial owner(s) of a property.

As such, it is important for both conveyancers and estate agents to understand the difference between beneficial and legal ownership. By understanding beneficial ownership, conveyancers and estate agents can help to ensure that their clients are legitimate and that any property transactions are above board.

How to identify the legal owner of a property

Land Registry is the best way for property professionals to find out who the legal owner of a property is. Land Registry lists all registered properties in England and Wales and includes information on the owner, mortgage lender, leasehold details, and any restrictions on the property.

If you want property title information fast alongside analysis of the title deeds, Veya offers just that. You can instantly generate a property title check report that gives you ownership details with the ability to perform AML checks to verify the owners. Veya plugs directly into Land Registry, so the information is always accurate and up to date.

How to identify the UBO of a property

Property professionals typically use a declaration of trust to determine the ultimate beneficial owner of a property. This document is signed by all parties involved in the trust, and it outlines each party’s rights and interests in the property.

By understanding the terms of the trust, property professionals can ensure that the property is used in accordance with the wishes of the ultimate beneficial owner. The Land Registry will contain any declarations of trust relevant to the property as a restriction on the title deeds.

If there isn’t a declaration of trust, it may still be possible to find out who the beneficial owner is. If the property is owned by a company, the company name will be listed. To find out who owns the company, you can check the Companies House Register – a public record of all companies registered in England and Wales. The Register will list the directors of the company, as well as any shareholders with more than 25% ownership in the company.

There is also a Register of Overseas Entities (ROE), which includes information on overseas companies and trusts that own or have an interest in UK property. The ROE is available to the public, but it can be difficult to find out who the beneficial owner is, as the information is not always up to date.

The UK government has plans to launch a public beneficial ownership register for UK property but have not confirmed when this will be legislated.

If you are unable to identify the UBO of a customer, you should consider whether the transaction poses a higher risk of money laundering or terrorist financing and take appropriate measures to mitigate that risk. For example, you may need to carry out enhanced due diligence on the customer. In some cases, you may decide to refuse to deal with a property if you cannot establish who the beneficial owner is.

Why is it important to identify the ultimate beneficial owner (UBO) of a property?

It is important to identify the ultimate beneficial owner for several reasons. Understanding who the beneficial owner is helps to satisfy anti-money laundering (AML) obligations. Property professionals need to carry out due diligence on the buyer and prove that the money to buy the property is from a legitimate source.

UBOs can be difficult to identify as they may be hidden behind complex structures such as trusts, companies or other legal entities. It is important to identify UBOs as part of your due diligence process when entering into transactions with customers. This is because you may be required to obtain additional information about them under money laundering regulations. For example, you may need to take reasonable measures to understand the ownership structure of a customer before entering into a transaction with them.

You should take care to identify the ultimate beneficial owner of a property before proceeding with a sale or purchase. By doing so, you can help to prevent crime, fulfil your AML obligations, and protect both buyers and sellers from becoming involved in fraudulent activity.

At Veya, we specialise in title deed analysis. Our reports will indicate if there is a restriction relating to beneficial owners or highlight if the property is company-owned and therefore what steps to take next. You can also ensure due diligence has been handled with our digital AML checks for conveyancers. Our HMRC-grade AML checks include PEP and sanction screening, so if enhanced due diligence is required on your UBO, we’ve got you covered.

The Financial Action Task Force (FATF) has best practices set out for legal professionals.

To find out more, book a demo with us – we would love to show you the platform!